Toronto, Ontario, August 9, 2016 – Pizza Pizza Royalty Corp. (the “Company”), which owns the Pizza Pizza and Pizza 73 Rights and Marks, released financial results today for the three months and six months ended June 30, 2016.

Second Quarter highlights:

- Royalty Pool sales increased 1.5%

- Same store sales increased 0.9%

- Monthly dividend increased 2.4% in June 2016

- Restaurant network grew by five, net locations

Year-to-date highlights:

- Royalty Pool sales increased 2.4%

- Same store sales increased 1.7%

- Restaurant network grew by seven locations

- Royalty Pool of restaurants increased by six, effective January 1, 2016

SALES

For the three months ended June 30, 2016 (“Quarter”), System Sales from the 736 restaurants in the Royalty Pool increased by 1.5% to $132.3 million from $130.3 million in the prior year quarter when there were 730 restaurants in the pool. For the six month period, Royalty Pool System Sales increased 2.4% to $265.3 million from $259.1 million in the same period last year.

Total Royalty Pool System Sales for the Quarter and the six months increased over the comparative periods in 2015 as a result of the reported same store sales growth (“SSSG”), and the impact of net new restaurants added to the Royalty Pool on January 1, 2016. The six months ended June 30, 2016 system sales also benefitted from the extra day of sales in February 2016 due to the leap year, which management estimates to be approximately $1.0 million.

SSSG, the key driver of yield growth for shareholders of the Company, increased by 0.9% (6.0% – 2015) for the Quarter when compared to the same period in 2015. Year-to-date, SSSG increased by 1.7% when compared to the same period in 2015 (4.2% – 2015). SSSG is not affected by the additional day in the leap year as SSSG is calculated using the 13-week and 26-week comparative basis.

SSSG is driven by the growth in the average customer check and in customer traffic both of which are affected by changes in pricing and sales mix. During the Quarter and for the six months, the average check increased while customer traffic decreased when compared to the same periods last year.

Paul Goddard, CEO, Pizza Pizza Limited (“PPL”), said: “At our Pizza Pizza restaurants, with the majority operating in a robust Ontario economy, we have taken selective price increases to offset rising food costs in order to maintain restaurant profitability. As can happen with price increases, we saw a slight contraction in customer traffic. At our Pizza 73 locations, we continue to encounter economic uncertainty in Alberta which is negatively affecting consumer spending patterns. Our Pizza Pizza sales represent 80% of our overall business, so positive sales growth at this brand offsets the sales reductions at Pizza 73.”

MONTHLY DIVIDENDS AND WORKING CAPITAL RESERVE

In June 2016, the Company increased the monthly dividend by 2.3% to $0.0713 per share. On an annualized basis, the dividend was increased by $0.019 to $0.8556 per share. The previous dividend increase was in November 2015, when the Company increased the monthly dividend by 2.5% to $0.0697 per share or $0.8364 annualized.

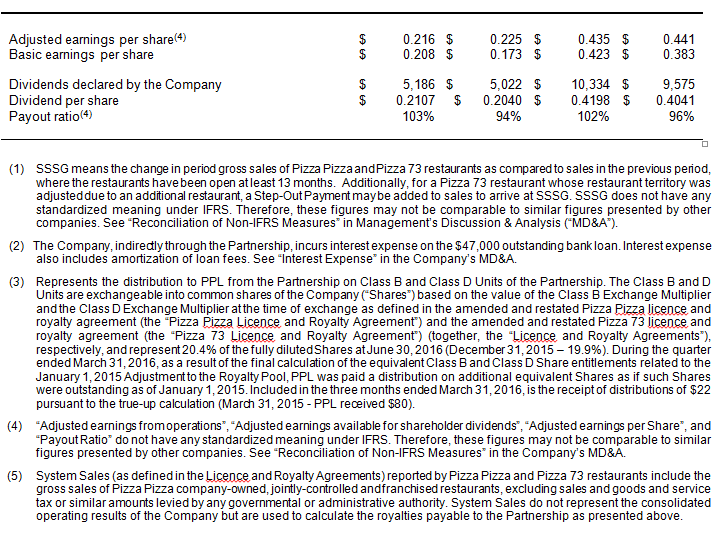

The Company declared shareholder dividends of $5.2 million, or $0.2107 per share, for the Quarter compared to $5.0 million, or $0.2040 per share, for the prior year comparable quarter. The payout ratio was 103% for the Quarter and was 94% for the prior year comparable quarter.

For the six months ended June 30, 2016, the Company declared dividends of $10.3 million, or $0.4198 per share, compared to $9.6 million, or $0.4041, for the prior year comparable period. The payout ratio was 102% for the six months and was 96% in the prior year comparable period.

For Canadian federal tax purposes, the dividend is considered a taxable eligible dividend.

The Company’s working capital reserve is $4.8 million at June 30, 2016, which is a decrease of $133,000 for the Quarter. The decrease in the reserve was the result of higher taxes payable by the Company and an increase in the dividend in June 2016.

The reserve is available to stabilize dividends and fund other expenditures in the event of short- to medium-term variability in System Sales and, thus, the Company’s royalty income. With this reserve in place, going forward, the Company will continue to target a payout ratio at or near 100% on an annualized basis. The Company does not have capital expenditure requirements or employees.

EARNINGS PER SHARE (“EPS”)

Fully-diluted EPS for the quarter was $0.208 per share compared to $0.173 per share for the same quarter in 2015. The increase in earnings for the Quarter and six months is attributable to increased royalty income and a decrease in interest expense, offset by an increase in current tax expense. Additionally, prior year earnings were negatively impacted by the non-cash swap termination costs recognized in April 2015 of $1.2 million.

However, instead of EPS, the Company considers “adjusted” EPS[1] to be a more meaningful indicator of the Company’s operating performance and, therefore, presents fully-diluted adjusted EPS. Adjusted EPS for the Quarter decreased 4.2% to $0.216 compared to $0.225 in the same quarter last year, and decreased 1.4% for the six months ended June 30, 2016. The prior year adjusted earnings benefited from a non-recurring tax deduction in the second quarter provided by the “non-cash swap termination costs” mentioned above. The benefit from the tax deduction increased adjusted EPS by $0.0107 in the second quarter of 2015. Without the tax deduction, adjusted EPS for the Quarter and six month period would have increased 0.8%[2] and 1.1%[3], respectively, over the prior year comparable periods.

CURRENT INCOME TAX EXPENSE

Current income tax expense for the Quarter was $1.4 million and $2.8 million for the six months. For the 2015 comparative quarter and six months, the current tax was $1.1 million and $2.3 million, respectively. The increase in tax expense over the prior year is largely due to the Company’s increased ownership percentage of Pizza Pizza Royalty Limited Partnership earnings in the current year coupled with the fact that the prior year’s taxable income was reduced by the “non-cash swap termination costs” mentioned above.

Of particular note is that the Company’s earnings from operations before income taxes, calculated under International Financial Reporting Standards (“IFRS”), differs significantly from its taxable income, largely due to the tax amortization of the Pizza Pizza and Pizza 73 Rights and Marks. The amount of the tax amortization deducted is based on a declining basis and will decrease annually.

RESTAURANT DEVELOPMENT

The number of restaurants in the Company’s Royalty Pool increased by six to 736 on the January 1, 2016 Adjustment Date. The number of restaurants in the Royalty Pool remained unchanged through June 30, 2016.

During the Quarter, PPL opened seven restaurants and closed two. By brand, for the Quarter, Pizza Pizza opened three traditional and four non-traditional restaurants; two non-traditional locations were closed. There was no change in the Pizza 73 locations.

For the six month period, PPL opened 11 restaurants and closed four, increasing the overall number of restaurants by seven. By brand, for the six months, Pizza Pizza opened five traditional restaurants and five non-traditional locations; two non-traditional locations were closed. Pizza 73 opened one non-traditional location; two non-traditional locations were closed.

Readers should note that the number of restaurants added to the Royalty Pool each year may differ from the number of restaurant openings and closings reported by PPL on an annual basis as the periods for which they are reported differ slightly.

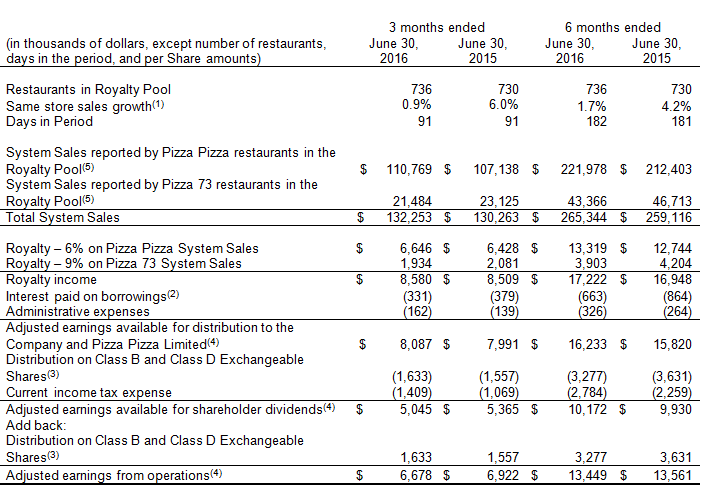

SELECTED FINANCIAL HIGHLIGHTS

The following table sets out selected financial information and other data of the Company and should be read in conjunction with the unaudited interim condensed consolidated financial statements of the Company. Readers should note that the 2016 results are not directly comparable to the 2015 results because of an extra day of royalty revenue in 2016 due to the leap year, in addition to the fact that there are 736 restaurants in the 2016 Royalty Pool compared to 730 restaurants in the 2015 Royalty Pool.

A copy of the Company’s unaudited interim condensed consolidated financial statements and related MD&A will be available at www.sedar.com and ppl-stg-fe-phx2.appspot.com after the market closes on August 9, 2016.

As previously announced, the Company will host a conference call to discuss the results. The details of the conference call are as follows:

Date: Wednesday August 10, 2016

Time: 9:00 a.m. ET

Call-in number: 416-340-2218 / 866-223-7781

Recording call in number: 905-694-9451 / 800-408-3053

Available until midnight, August 24, 2016

Passcode: 2401591

A recording of the call will also be available on the Company’s website ppl-stg-fe-phx2.appspot.com.

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this report, such statements include such words as “may”, “will”, “expect”, “believe”, “plan”, and other similar terminology. These statements reflect management’s current expectations regarding future events and speak only as of the date of this report. These forward-looking statements involve a number of risks and uncertainties, including those described in the Company’s annual information form. The Company assumes no obligation to update these forward looking statements, except as required by applicable securities laws.

For further information:

Curt Feltner, Chief Financial Officer, Pizza Pizza Limited

(416) 967-1010 x307

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.

Christine D’Sylva, Vice President, Finance & Investor Relations, Pizza Pizza Limited

(416) 967-1010 x393

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.