Toronto, Ontario, February 28, 2018 – Pizza Pizza Royalty Corp. (the “Company”), which owns the Pizza Pizza and Pizza 73 Rights and Marks, released financial results today for the three months and year ended December 31, 2017.

Fourth Quarter highlights:

- Royalty Pool sales increased 0.7%

- Same store sales decreased 0.7%

- Restaurant network grew by six locations

Annual highlights:

-

Royalty Pool sales increased 1.1%

-

Same store sales decreased 0.1%

-

Restaurant network grew by eight locations

-

Royalty Pool of restaurants increased by 15 effective January 1, 2017

SALES

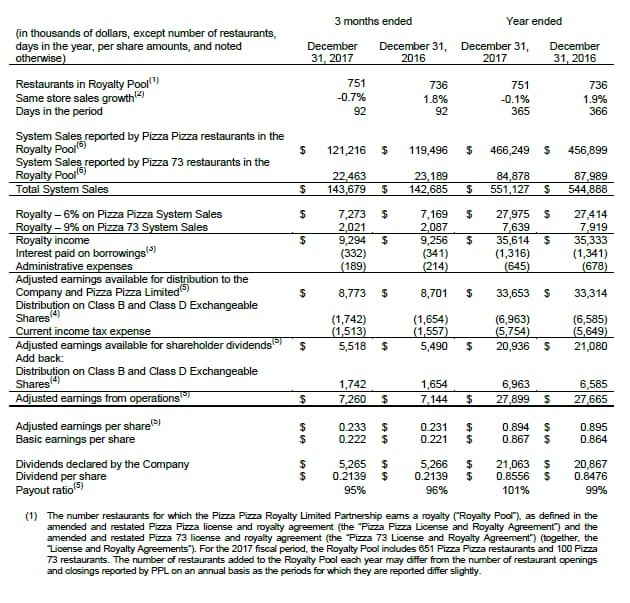

For the three months ended December 31, 2017 (“Quarter”), System Sales from the 751 restaurants in the Royalty Pool increased 0.7% to $143.7 million from $142.7 million in the prior year comparable quarter when there were 736 restaurants in the Royalty Pool. For the year, Royalty Pool System sales increased 1.1% to $551.1 million from $544.9 million in the prior year.

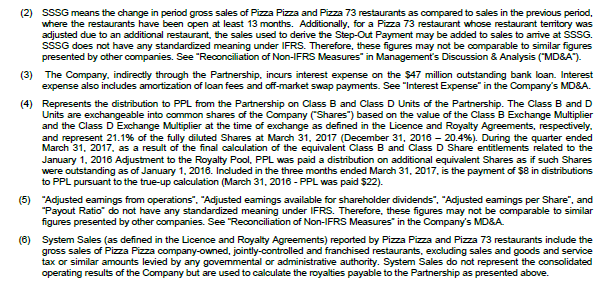

Royalty Pool System Sales for the three months and year increased over the comparative periods in 2016 as a result of the change in same store sales growth (“SSSG”) and the impact of restaurants added to the Royalty Pool on January 1, 2017. Additionally, System Sales in 2016 included an extra day of sales in February 2016 due to the leap year, which management estimated to be $1.0 million. The extra day of sales in the prior year should be considered when comparing 2017 aggregate System Sales to 2016.

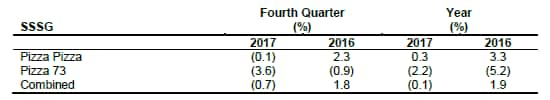

SSSG, the key driver of yield growth for shareholders of the Company, decreased by 0.7% for the Quarter compared to a 1.8% increase in the same quarter last year. For the year, SSSG decreased by 0.1% compared to a 1.9% increase in 2016.

SSSG is driven by the change in the customer check and customer traffic, both of which are affected by changes in pricing and sales mix. During the Quarter the average customer check increased when the two brands are combined, while the customer traffic counts decreased slightly. For the year, the average customer check decreased slightly, while traffic increased; the traffic increase is due to Pizza Pizza activity, operating largely in eastern Canada, and accounting for over 80% of total sales. The decrease in the average check was the result of Pizza Pizza marketing campaigns rolling back prices during its 50th anniversary celebrations. The Pizza 73 traffic counts continue to be negatively impacted by the weakened Alberta economy, resulting in negative SSSG.

Paul Goddard, C.E.O., Pizza Pizza Limited, said: “The Pizza 73 brand, operating in western Canada, continues to be negatively impacted by the weakened Alberta economy, however, the brand’s market-leading strength produced eight restaurant openings in 2017, expanding further into new markets. At both our brands, as many provinces increase the minimum wage, 2018 marketing strategies will be structured to guard restaurant profitability while also driving customer traffic to our restaurants and also to our wide array of digital ordering platforms.”

MONTHLY DIVIDENDS AND WORKING CAPITAL RESERVE

In the Quarter, the Company declared shareholder dividends of $5.3 million, or $0.2139 per Share, which is unchanged from the prior year comparable quarter. The payout ratio was 95% for the Quarter and was 96% in the same quarter last year.

For the year, the Company declared shareholder dividends of $21.1 million, or $0.8556 per Share, compared to $20.9 million, or $0.8476 per Share, for 2016. The payout ratio was 101% for the year compared to 99% in the prior year.

For Canadian federal tax purposes, the dividend is considered a taxable eligible dividend.

The Company’s working capital reserve is $5.1 million at December 31, 2017, which is a decrease of $119,000 since December 31, 2016. The decrease in the reserve was the result of relatively flat adjusted earnings, coupled with an increase in the dividend effective June 2016.

With this reserve in place, the Company will continue to target an annual payout ratio at or near 100% on an annualized basis.

The reserve is available to stabilize dividends and fund other expenditures in the event of short- to medium term variability in System Sales and, thus, the Company’s royalty income. The Company does not have capital expenditure requirements or employees.

EARNINGS PER SHARE (“EPS”)

Fully-diluted basic EPS for the Quarter increased 0.5% to $0.222 per share compared to $0.221 per share for the same quarter in 2016. For the year, the basic EPS increased 0.3% to $0.867 per share compared to $0.864 per share for 2016. EPS was relatively flat year over year, as the increase in royalty income was offset by the increase in current tax.

As compared to basic EPS, the Company considers “adjusted” EPS1 to be a more meaningful indicator of the Company’s operating performance and, therefore, presents fully-diluted adjusted EPS. Adjusted EPS for the Quarter increased 0.7% to $0.233 when compared to the same period of 2016, and decreased 0.1% to $0.894 for the year compared to 2016.

CURRENT INCOME TAX EXPENSE

Current income tax expense for the Quarter was $1.5 million and $5.8 million for the year. For the 2016 comparable quarter and annual period, the current tax was $1.6 million and $5.6 million, respectively. The tax expense increased in 2017 due to an increase in royalty income plus the fact that the available tax amortization on undepreciated capital assets decreased for the period.

Of particular note is that the Company’s earnings from operations before income taxes, calculated under International Financial Reporting Standards (“IFRS”), differs significantly from its taxable income, largely due to the tax amortization of the Pizza Pizza and Pizza 73 Rights and Marks. The amount of the tax amortization deducted is based on a declining basis and will decrease annually.

RESTAURANT DEVELOPMENT

The number of restaurants in the Company’s Royalty Pool increased by 15 locations to 751 on the January 1, 2017 Adjustment Date. The number of restaurants in the Royalty Pool will remain unchanged through December 31, 2017.

During the Quarter, Pizza Pizza Limited (“PPL”) opened eight restaurants and closed two. By brand, for the Quarter, Pizza Pizza opened one traditional and five non-traditional restaurants; two non-traditional locations were closed. Pizza 73 opened one traditional and one non-traditional restaurant during the Quarter.

For the year, PPL opened 26 restaurants and closed 18. By brand, for the year, Pizza Pizza opened six traditional and 11 non-traditional restaurants; eight traditional and eight non-traditional locations were closed. Pizza 73 opened eight traditional restaurants and one non-traditional location; two Pizza 73 nontraditional locations were closed.

Readers should note that the number of restaurants added to the Royalty Pool each year may differ from the number of restaurant openings and closings reported by PPL on an annual basis as the periods for which they are reported differ slightly.

SELECTED FINANCIAL HIGHLIGHTS

The following table sets out selected financial information and other data of the Company and should be read in conjunction with the consolidated financial statements of the Company. Readers should note that the 2017 results are not directly comparable to the 2016 results because of an extra day of royalty revenue in 2016 due to the leap year, in addition to the fact that there are 751 restaurants in the 2017 Royalty Pool compared to 736 restaurants in the 2016 Royalty Pool.

A copy of the Company’s audited consolidated financial statements and related MD&A will be available at www.sedar.com and ppl-stg-fe-phx2.appspot.com after the market closes on February 28, 2018.

As previously announced, the Company will host a conference call to discuss the results. The details of the conference call are as follows:

Date: Thursday, March 1, 2018

Time: 9:00 a.m. ET

Call-in number: 647-427-7450 / 1-888-231-8191

Recording call in number: 416-849-0833 / 1-855-859-2056

Available until midnight, March 15, 2018

Passcode: 6477748

A recording of the call will also be available on the Company’s website at ppl-stg-fe-phx2.appspot.com.

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this report, such statements include such words as “may”, “will”, “expect”, “believe”, “plan”, and other similar terminology. These statements reflect management’s current expectations regarding future events and speak only as of the date of this report. These forward-looking statements involve a number of risks and uncertainties, including those described in the Company’s annual information form. The Company assumes no obligation to update these forward looking statements, except as required by applicable securities laws.

For further information:

Curt Feltner, Chief Financial Officer, Pizza Pizza Limited

(416) 967-1010 x307

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.

Christine D’Sylva, Vice President, Finance & Investor Relations, Pizza Pizza Limited

(416) 967-1010 x393

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.

[1] Adjusted earnings and adjusted EPS are not recognized measures under International Financial Reporting Standards (“IFRS”) and may be calculated in a manner that differs from that used by other issuers. For additional information about the calculation and use of these measures, please see “Reconciliation of Non-IFRS Measures” in the Company’s Management’s Discussion & Analysis (“MD&A”).