Toronto, Ontario, August 7, 2019 – Pizza Pizza Royalty Corp. (the “Company”), which owns the Pizza Pizza and Pizza 73 Rights and Marks, released financial results today for the three and six months ended June 30, 2019.

Second quarter highlights:

- Royalty Pool sales increased 2.4%

- Same store sales increased by 1.6%

- Restaurant network decreased by nine locations

Year-to-date highlights:

- Royalty Pool sales increased 0.7%

- Same store sales growth was 0%

- Restaurant network decreased by 12 locations

- Royalty Pool of restaurants increased by 14 net restaurants effective January 1, 2019

SALES

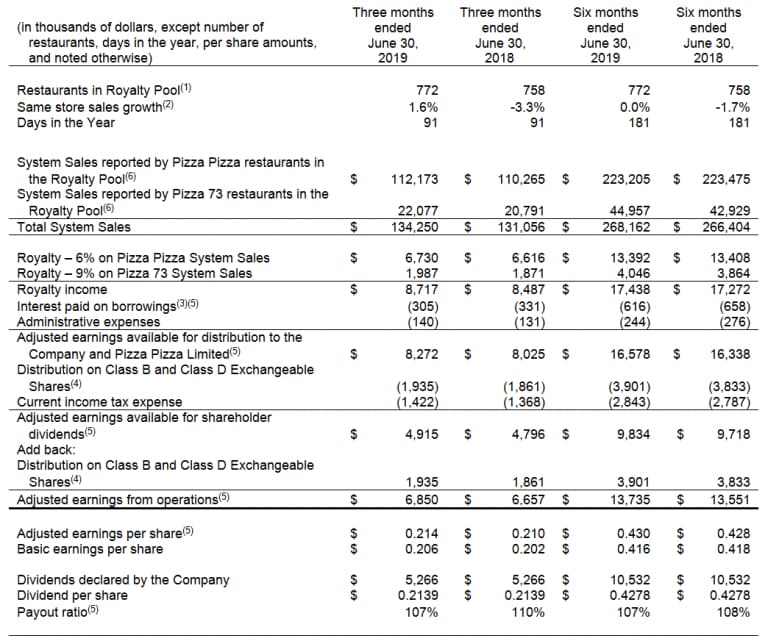

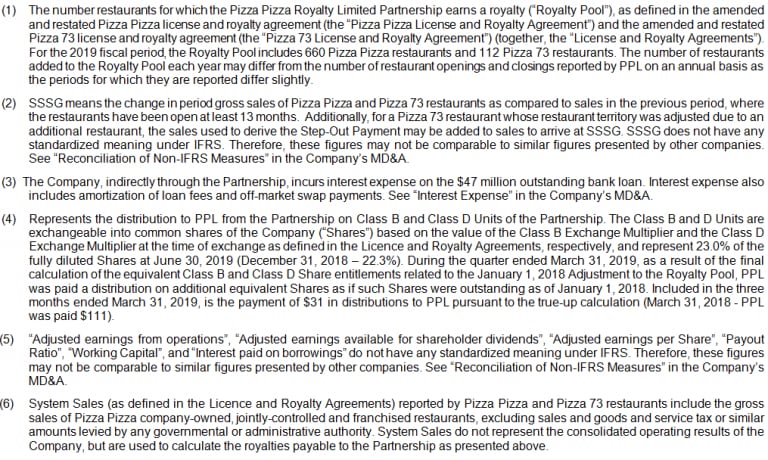

For the three months ended June 30, 2019 (“Quarter”), System Sales from the 772 restaurants in the Royalty Pool increased 2.4% to $134.3 million from $131.1 million in the prior year comparable quarter when there were 758 restaurants in the Royalty Pool. For the six months ended June 30, 2019, Royalty Pool System Sales increased 0.7% to $268.2 million compared to $266.4 million in the same period last year.

Total Royalty Pool System Sales for the Quarter increased over the comparative period as a result of the reported increase in same store sales growth (“SSSG”) and the new restaurants added to the Royalty Pool on January 1, 2019.

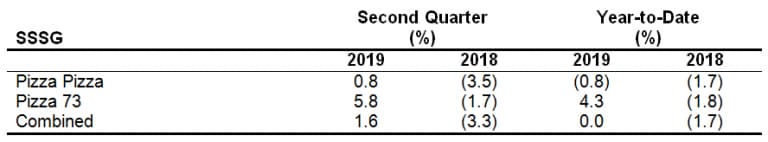

SSSG, the key driver of yield growth for shareholders of the Company, increased by 1.6% for the Quarter compared to the same quarter last year. Year-to-date, SSSG was flat when compared to the same period in 2018.

SSSG is driven by the change in the customer check and customer traffic, both of which are affected by changes in pricing and sales mix. During the Quarter, the average customer check and customer traffic increased when measured against the same period last year. For the six months, the average check increased and customer traffic decreased. For several consecutive quarters, the average customer check has moderated as a result of value-driven pricing on the lead pizza offerings as PPL executed on its strategy to grow customer traffic at both brands.

Paul Goddard, CEO, Pizza Pizza Limited said, “We were pleased with the second quarter results, especially the growth in traffic, as customers responded positively to our new product offerings and value-oriented promotional campaigns. Pizza 73 continues its positive sales momentum in the underperforming western economies, further outpacing competitors.”

MONTHLY DIVIDENDS AND WORKING CAPITAL RESERVE

In the Quarter, the Company declared shareholder dividends of $5.3 million, or $0.2139 per Share, which is unchanged from the prior year comparable quarter. The payout ratio was 107% for the Quarter and was 110% in the comparative quarter last year.

For the six-month period, the Company declared shareholder dividends of $10.5 million, or $0.4278 per Share, which is unchanged from the prior year comparable period. The payout ratio was 107% for the Period and was 108% in the prior year comparable period.

The Company’s working capital reserve is $3.5 million at June 30, 2019, which is a decrease of $732,000 since December 31, 2018. The decrease in the reserve is largely attributable to the 107% payout ratio for the first six months of the year when system sales are historically weaker than the second half of the year due to seasonality in restaurant sales.

With this reserve in place, the Company will continue to target an annual payout ratio at or near 100% on an annualized basis.

EARNINGS PER SHARE (“EPS”)

Fully-diluted basic EPS increased 2.0% to $0.206 for the Quarter and decreased 0.5% to $0.416 year-to-date when compared to the prior year.

As compared to basic EPS, the Company considers “adjusted” EPS[1] to be a more meaningful indicator of the Company’s operating performance and, therefore, presents fully-diluted adjusted EPS. Adjusted EPS for the Quarter increased 2.1% to $0.214 when compared to the same period in 2018, and increased 0.5% for the first six months.

CREDIT FACILITY

On June 28, 2019, the Pizza Pizza Royalty Limited Partnership amended and extended its $47 million credit facility with a syndicate of chartered banks from April 2020 to April 2025. The current interest rate, which began April 24, 2015 and is projected to remain unchanged through April 2020, is 2.75%, and is comprised of a portion fixed with swaps of 1.875% plus the credit spread, currently set at 0.875%. Additionally, the Company’s subsidiary entered into a five year forward swap arrangement, commencing April 2020. Beginning on that date, the credit facility will have a new, effective interest rate of 2.685% comprised of a fixed rate of 1.81% plus a credit spread, currently at 0.875%.

RESTAURANT DEVELOPMENT

The number of restaurants in the Company’s Royalty Pool increased by 14 locations to 772 on the January 1, 2019 Adjustment Date. The number of restaurants in the Royalty Pool will remain unchanged through December 31, 2019.

During the Quarter, PPL opened two non-traditional Pizza Pizza restaurants; three traditional and four non-traditional Pizza Pizza restaurants were closed. At the Pizza 73 brand, four non-traditional restaurants.

For the first six months, PPL opened two traditional Pizza Pizza restaurants, one in Quebec and one in British Columbia; six traditional Pizza Pizza restaurants were closed. Additionally, six non-traditional Pizza Pizza locations were opened and eight non-traditional locations were closed. At the Pizza 73 brand, one traditional and five non-traditional restaurants.

Readers should note that the number of restaurants added to the Royalty Pool each year may differ from the number of restaurant openings and closings reported by PPL on an annual basis as the periods for which they are reported differ slightly.

[1] Adjusted earnings and adjusted EPS are not recognized measures under International Financial Reporting Standards (“IFRS”) and may be calculated in a manner that differs from that used by other issuers. For additional information about the calculation and use of these measures, please see “Reconciliation of Non-IFRS Measures” in the Company’s Management’s Discussion & Analysis (“MD&A”).

SELECTED FINANCIAL HIGHLIGHTS

The following table sets out selected financial information and other data of the Company and should be read in conjunction with the consolidated financial statements of the Company. Readers should note that the 2019 results are not directly comparable to the 2018 results because of the fact that there are 772 restaurants in the 2019 Royalty Pool compared to 758 restaurants in the 2018 Royalty Pool.

A copy of the Company’s interim condensed consolidated financial statements and related MD&A will be available at www.sedar.com and ppl-stg-fe-phx2.appspot.com after the market closes on August 7, 2019

As previously announced, the Company will host a conference call to discuss the results. The details of the conference call are as follows:

Date: Wednesday, August 7, 2019

Time: 5:00 p.m. ET

Call-in number: 647-427-7450 / 1-888-231-8191

Conference ID: 7678016

Recording call in number: 416-849-0833 / 1-855-859-2056

Available until midnight, August 21, 2019

Passcode: 7678016

A recording of the call will also be available on the Company’s website at ppl-stg-fe-phx2.appspot.com.

Forward Looking Statements

Certain statements in this report may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this report, such statements include such words as “may”, “will”, “expect”, “believe”, “plan”, and other similar terminology. These statements reflect management’s current expectations regarding future events and speak only as of the date of this report. These forward-looking statements involve a number of risks and uncertainties, including those described in the Company’s annual information form. The Company assumes no obligation to update these forward looking statements, except as required by applicable securities laws.

For further information:

Curt Feltner, Chief Financial Officer, Pizza Pizza Limited

(416) 967-1010 x307

cfeltner@pizzapizza.ca

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.

Christine D’Sylva, Vice President, Finance & Investor Relations, Pizza Pizza Limited

(416) 967-1010 x393

cdsylva@pizzapizza.ca

ppl-stg-fe-phx2.appspot.com and www.pizza73.com or www.sedar.com.